RECB Review – Ponzi Scheme – MLM Scam

Website & Company Information

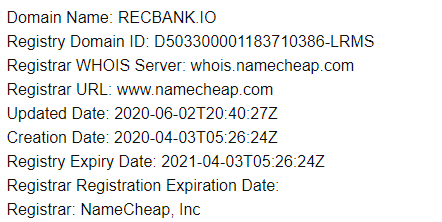

The web domain of the company was privately registered on the 3rd of April 2020 and was later updated on 2020–06–02. According to the site, the company is based out of London, UK.

The website provides no information about who owns or runs the company. Despite the company behind run out of London, RECB’s official Vimeo presentation is in Spanish. So either the admins are targeting the Spanish audience, or they are from the Latin American region and have registered a shell company in London because its easy to do so. Research reveals the street address provided is that of the fictional detective Sherlock Holmes.

As always, if the company is not being transparent about its corporate structure, then you must think twice before handing over your hard-earned money to anonymous people on the internet.

RECB’s Products

The company has no retailable products or services, with affiliates only able to market RECB affiliate membership itself.

RECB’s Compensation Plan

The affiliates of the company are required to invest anywhere between $50 to $1500 on the promise of a 1000% ROI paid over 365 days.

All the referral commissions to these affiliates are paid down 7 levels of profits. There’s also a $150 bloque investment scheme, which appears to pay commissions based on recruitment of affiliates who also invest in $150 “bloques”.

Joining RECB

Joining RECB affiliate membership is free. However, full participation in the attached income opportunity requires a minimum investment of $50, and it goes as high as $1500.

Conclusion

The company claims of generating external revenue via various real-estate activities. However, there is no proof of such an income stream. Nor is there evidence of RECB generating external revenue from any additional sources.

Ponzi Scheme

As it stands, the only money going into the system is new investments by new affiliates. And using the new investment to honour existing withdrawals makes it a Ponzi Scheme. When the new funds stop coming in, the system will collapse, and the majority of the participants will lose money.

Bank

The company has also been referring to itself as a bank. This attracts additional regulatory attention in most jurisdictions. They are also violating securities law.